KSG Exec Brief: Fool me once...

First with Russia, and now in the Middle East, multinational firms are fundamentally shifting their mindset and security posture for a world of increasing geopolitical risk.

Insight

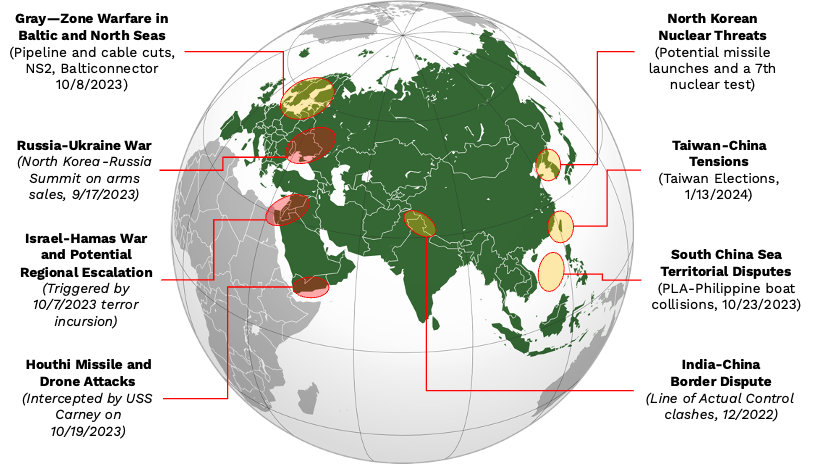

Key geopolitical flashpoints are forming an arc of instability around the Eurasian periphery. While the conflicts and tensions in each potential crisis zone are nominally independent of each other, they are increasingly linked to a global dynamic driven by an alignment of authoritarians (in China, Russia, Iran, and North Korea) with ambitions to challenge the US-led international order.

Since Russia’s invasion of Ukraine in February 2022, geopolitical risk has increasingly preoccupied multinational executives and boards. As events in the Middle East straddle the knife’s edge of regional conflict, it is critical that leaders step back and consider this pattern of crises in a wider global context.

The global risk environment is driven by the strategic ambitions of an alignment (some say Axis) of autocrats running China, Russia, Iran, and North Korea (CRINK). These countries create zones of potential conflict spanning the entire Eurasian periphery, from the Artic Circle, North and Baltic Seas, through Eastern Europe, the Balkans, the Middle East, the India-Pak-China border, the South China Sea, Taiwan, and the Korean Peninsula. We highlight key specific flashpoints in these areas below.

Some of these are in a low simmer, some are heating up, and others are at full boil. Each are also increasingly linked and interdependent — witness North Korea-Russia strategic arms agreements, Russian and Chinese support to Iran and its proxies, Iran’s support for Russian aggression in Ukraine, and India’s balancing of its strategic imperatives at its border with China and its contribution to counter-China deterrence over Taiwan, while remaining vigilant of Pakistan’s actions nearby. Just this week, a Chinese ship rammed a Philippines naval vessel on its way to resupply its military outpost on a shoal in the South China Sea. Washington is now concerned that a mutual defense treaty could be used to ask the US to help deliver supplies to the island, as it did in 2014. Sparks could fly in the coming weeks.

While each of these principal US-adversaries conducts individual operations out of their narrow strategic interests, KSG expects an increasing convergence of military and intelligence collaboration, diplomatic initiatives, technology and arms transfers, and economic warfare activities designed to amplify malign effects on the West and shore up each countries’ relative weaknesses.

The coupled nature of these flashpoints creates an environment where spillover risks are heightened—individual, local conflicts can quickly pull in great powers and spark catastrophic confrontations. Short of outright war, these dynamics increase the baseline level of geopolitical risk, introduce more uncertainty and cost into business operations and supply chains, and consume executive and organizational bandwidth.

What Executives and Boards Should Do

To best navigate this uncertain, but likely sustained, period of elevated geopolitical risk C-Suites and boards should:

Examine, test, and refine crisis management plans and processes, with a focus on enterprise-wide operational coordination, situational awareness, and strategic decision-making — these should include all key functions spanning executive leadership, legal, finance, IT/cyber, comms/PR, HR, supply chain, product/sales, physical security, government affairs and business continuity/disaster recovery.

Evaluate the adequacy of sources of geopolitical and cyber risk intelligence (both informal/CEO-rolodex and formal advisory services) and internal sensemaking processes to inform strategic decision-making in a crisis environment.

Ensure security teams and tooling are adequate to protect and defend corporate networks and data against geopolitically motivated cyberattacks or compromises.

Consider first, second, and third-order impacts from potential operational disruptions on supply chains, network reliability/integrity, revenue projections, key partners, critical customers, and staff — identify and prioritize at-risk assets and suppliers for resilience and/or redundancy.

For more information or assistance on these issues, please reach out to intel@ks.group.

Forwarded this Exec Brief by a friend? Click below to sign up for our weekly dispatch.

Global Scan

Geopolitics

US Moves to Deter Iran as Israeli Invasion of Gaza Imminent: The Pentagon is rushing defensive systems into the region amid growing fears that Iran and its proxies will escalate attacks on US forces and allied interests.

China Ousts Defense Minister, Sparking Speculation: Two months after he disappeared from public view, General Li Shangfu became the second high-profile minister to lose his job without any official explanation, following former foreign minister Qin Gang in July.

Finland Claims Hong Kong-Flagged Ship Damaged Pipeline: An anchor possibly belonging to a Chinese vessel was found on the sea floor near the site of the damage to the connector linking Finland and Estonia, which has spurred worries of sabotage.

Cybersecurity

Okta Support System Breach Impact Spreads to Customers: Hacker’s breached the single sign-on technology company’s customer support unit, impacting at least one percent of its 17,000 client organizations, including Cloudflare and 1Password.

US Aims to Enhance Global Counter-Ransomware Initiative: The Biden administration is set to host officials from 50 countries next week, where it will aim to establish a norm against ransom payments and roll out sharing platforms, including on cryptocurrency.

Strategic and Emerging Tech

Intel CEO Says Immigration Key to Winning Chip War: Foreign nationals make up more than 60 percent of advanced STEM degrees, but immigration policies make it difficult for US companies to hire and retain them.

Startup Atom Computing Claims Quantum Milestone: The company announced its internal testing of a 1,180 qubit quantum computer that will be available to customers next year. Current emphasis is on running algorithms under the error threshold as the technology improves.

China Set to Dominate Deep-Sea Mining: The country holds 5 of the 30 exploration licenses that the International Seabed Authority (ISA) has granted to date – 17 percent of the total area – in preparation to start excavations of critical ores as soon as 2025.

Policy/Regulation

White House Finalizing AI Executive Order: The document will leverage government purchasing power to require advanced AI models to undergo assessments before they can be used by federal workers, and will ease immigration barriers for highly skilled workers.

CISA to Update National Cyber Incident Response Plan: After being mandated as part of the 2023 National Cybersecurity Strategy, the agency is working with the National Cyber Director to release a draft of the updated document for public comment by December, with the new plan expected to be approved and published by the end of next year.

Biden Announces Tech Hubs Across US, Puerto Rico: The initiative will distribute $500 million in grants to cities that invest in critical technologies like biotechnology, critical materials, quantum computing, advanced manufacturing.

Bookmarks